Facebook’s light approach to corporate governance

A critical analysis of Facebook’s corporate governance structures and processes

1. Introduction

On April 3, 2021, 533 million phone numbers and personal data of Facebook users have been leaked online in a low-level hacking forum. Even though the data was scraped in 2019, the Alon Gal, CTO of cybercrime intelligence firm Hudson Rock, who first discovered the leaked data, pointed out Facebook’s duty regarding power, privacy and ethics:

“Individuals signing up to a reputable company like Facebook are trusting them with their data and Facebook [is] supposed to treat the data with utmost respect. Users having their personal information leaked is a huge breach of trust and should be handled accordingly.”¹

Data has become Facebook’s new critical infrastructure. But what new requirements does this digital disruption pose to the Facebook board’s accountability.

In this essay, I will apply the ideas, concepts, and theories from Corporate Governance theory, to critique certain aspects of Facebook’s corporate governance structures and processes. I will discover and analyse the discrepancy between what Facebook says about its governance and ethics on data privacy and security, fake news, etc. and what it does. In the following, I will first analyse the Facebook’s board structure and processes. Second, I will examine the financial structure and situation. Third, I will investigate risk and its internal control systems. Fourth, I will lay out Facebook’s relationships with and prioritisation of different stakeholders. Fifths, I will explain the general context in which Facebook operates.

2. Critical analysis of Facebook’s governance structures and processes

2.1 “Good” corporate governance

The purpose of “good” corporate governance is to facilitate (1) effective, (2) entrepreneurial and prudent management that can deliver the (3) long-term success of the company.² Therefore, the scope of governance today goes beyond the narrowly defined mitigation of company economist’s “agency problem”³ of the agency theory and stakeholder theory. The relevance of ethics to business and “social responsibility”⁴ became focus points in the current debate.

2.2 Wates corporate governance principles

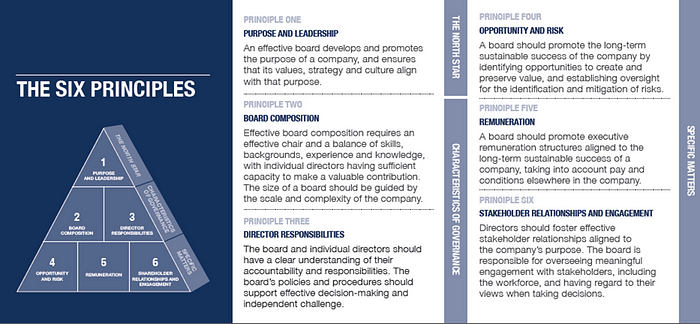

The Wates corporate governance principles⁵ provide a tool for large private companies to improve corporate governances. The six principles comprise purpose, board composition, board responsibilities, remuneration, and stakeholder relationships.

First, the effective board (1) is defined as a board that develops and promotes the purpose of the firm (purpose) and ensures that values, strategy, and culture⁶ are aligned to it. It is also determined by an effective chair and a balance of skills, backgrounds, experience, and knowledge of the directors (board composition). In addition, an effective board is characterised by policies and procedures that ensure effective decision-making (director responsibilities). Finally, the effectiveness of the board is indicated by effective stakeholder relationships⁷ (stakeholder relationships).

Second, the entrepreneurial board management (2) is determined by future-oriented processes to identify opportunities for innovation and entrepreneurship (opportunity and risk). Third, the long-term sustainable success⁸ of the firm (3) is achieved by the board through the identification of opportunities to create and preserve value (opportunity and risk). It is also defined by the alignment of executive remuneration to the long-term success (remuneration).

The definition of “good” corporate governance and Wates six principles build the foundation of the analysis of the disconnect between what Facebook says about its governance and ethics and what it does.

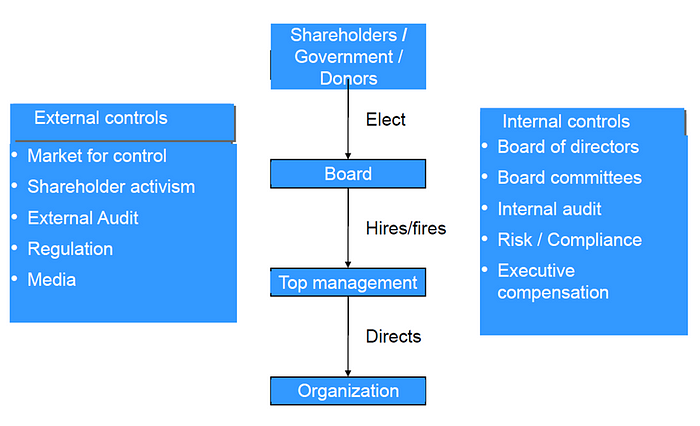

2.3 The mechanisms of governance

To critique certain aspects of Facebook’s corporate governance structures and processes, I will apply the framework “The mechanisms of governance to the organisation”⁹. The framework consists of board processes, external and internal controls. Frist, processes comprise the election of the board by the shareholders, government, and donors. The board has the responsibility to hire and fire the top management. The top management directs the organisation. Second, external controls of the board contain the market for control, shareholder activism, external audit, regulation, and media. Third, internal controls comprise board of directors, board committees, internal audit, risk and compliance, and executive compensation.

To analyse the director’s and board of directors’ role and responsibilities in Facebook’s decision-making, rights and duties of shareholders, and relevance of stakeholders, I will examine the internal controls mechanisms — specifically, the board of directors, board committees, internal audit, risk and compliance, and executive compensation¹⁰.

2.4 Facebook’s board structure and processes

2.4.1 Board composition

In general, a “good” corporate governance board structure and processes are constituted by internal controls such as an effective board composition. According to the Financial Reporting Council, an effective board is characterised by an effective chair and balanced skills, backgrounds, experience, and knowledge of its board of directors. This means that individual directors are “thinly informed, under resourced, and boundedly motivated directors”¹¹ and have the necessary capacity to contribute value. The scale and complexity of the firm determines the size of the board.¹²

The Facebook board composition¹³ might not seem to dispose the appropriate expertise and experience. After the major Cambridge Analytica Scandal in 2016 early, long-term board advisory to the CEO, turned away from the firm (reactive, one-shot board processes). This board shake up might have resulted in taking less experienced new members on the board.

In 2019, Facebook’s board experienced another shake-up with the loss of three members as part of the company’s governance change. Netflix CEO Reed Hastings and former White House Chief of Staff Erskine Bowles, the longest-serving board members, stepped down. Both did not have investments in the company and close ties to its executive management and Hastings was renowned to clash openly with Facebook’s CEO. The third board member, Dr. Susan Desmond-Hellmann, former CEO of the Bill & Melinda Gates Foundation, and the lead “independent” director stepped down later in the year.

2.4.2 Board effectiveness

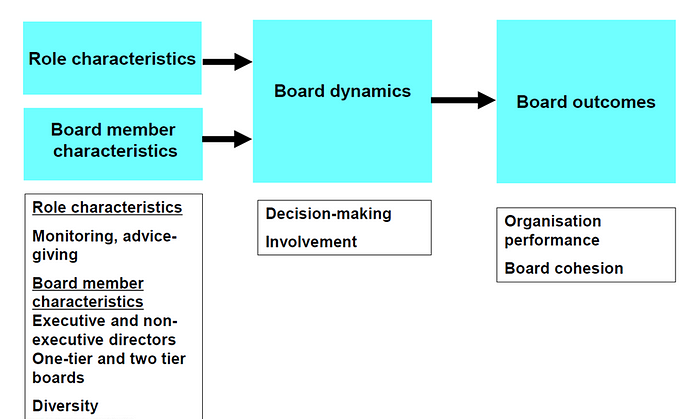

To analyse the board structure, I will use the framework “Board effectiveness”¹⁴. Its key elements are role characteristics and board member characteristics, board dynamics as well as board outcomes. First, the role characteristics are defined by monitoring and advice giving. Second, the board member characteristics have the dimensions executive and non-executive directors, one-tier and two-tier boards, and diversity. Third, the board dynamics contain decision making and involvement. Fourth, the board outcomes can be defined by the organisation performance and board cohesion.

Role characteristics of board

Frist, the board is generally required to fulfil two core roles¹⁵: monitoring and advice. In its monitoring function¹⁶ the board monitors the performance of the executive management and ensure accountability to the owners and stakeholders. Therefore, it reviews and approves the strategy and evaluates the internal controls and risk. In Facebook’s case the monitoring function might not be fully executed. The fact that Drew Houston, Dropbox CEO, and Zuckerberg’s close friend, was added to the board in 2020, decreased the hope of shareholders that board members put more pressure on the CEO.

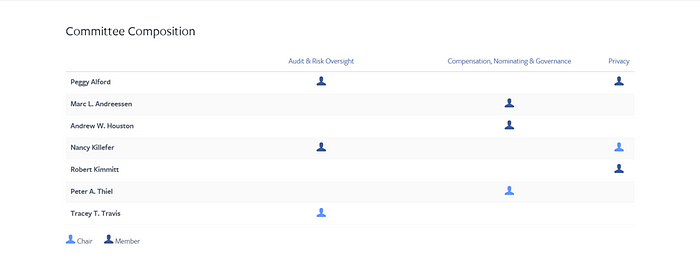

In its advisory function, the board advices the executive management in a resource and service role. This means that directors provide advice to the management and facilitate contacts, knowledge and resources between the firm and its stakeholders. At Facebook, the new board member Nancy Killefer from the U.S. Department of the Treasury under Obama might potentially bring valuable government insight to Facebook. The third new board member Tracey Travis, EVP and CFO of Estée Lauder, brings competencies such as a strong finance and corporate leadership background.

Board of directors’ characteristics

Second, the board of directors’ characteristics¹⁷ are constituted by two types of directors: executive directors and “independent” directors. But in Facebook’s case of a one-tier board there is a clash of interest between the two director types: Zuckerberg’s double role¹⁸ as the CEO and chairman of the board (powerful CEO). In 2018 and 2019 shareholders have multiple times proposed to remove Zuckerberg for the chairman position, but the board continued to support him.

In general, the insider or executive directors are the organisation’s CEO and other full-time top-level managers. The CEOs responsibility is to run the company. In Facebook’s case, its CEO Zuckerberg does not seem to have the appropriate expertise and experience to lead the increasingly scaled firm in these challenging times with success. Zuckerberg is an Engineer by education and his only professional experience is as a founder of Facebook. During the Cambridge Analytica scandal in 2016, he was criticized for running the company like an engineer, not as a Chief Executive Officer. He downplayed the scandal and acted reluctant to transparency requests which caused widely critique from the media and intensifying scrutiny from the U.S. government (increasingly politicised board processes). In recent years, the pressure from society and regulators onto the biggest technology companies — especially Facebook — increased due to privacy and competition issues (board processes reliant on law and regulation).

Generally, the outsider, non-executive, or “independent” directors are directors which are not involved in the management of the company. The “independent” non-executive director is not a representative of a shareholder and does not have a direct or indirect interest in the company. The board’s chair is responsible for running the board. Facebook has a non-executive majority board but only in 2020 the former Deputy Secretary of the Treasury Robert Kimmitt filled the vacant lead “independent” board director role. Shareholders now expect him to have a healthy level of a “devil’s advocate”-attitude towards Facebook’s impact on democracy and human rights.

Diversity¹⁹

With six male and five female board members, the board is nearly gender balanced.

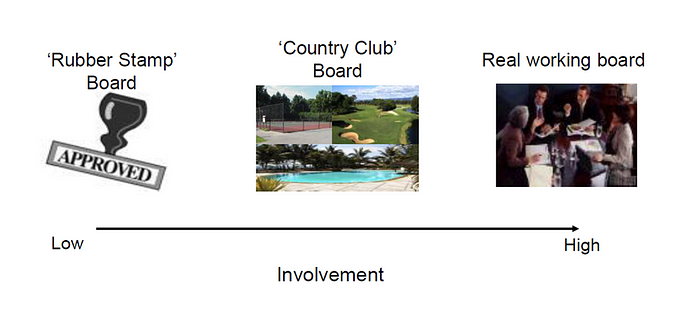

Board dynamics

Third, the board dynamics²⁰ vary among boards according to the board’s involvement. At the low involvement continuum is the “Rubber Stamp” board. The “Country Club” board is characterised by medium involvement. At the other end of the continuum is the real working board with a high involvement. At Facebook, the board can be judged as “Country Club” with medium involvement and personal relationships. The repeated rejection of shareholder’s appeals to resign Zuckerberg as Chairman by the board, shows that there are no board members who will put pressure on the CEO.

2.4.3 Market model governance chain

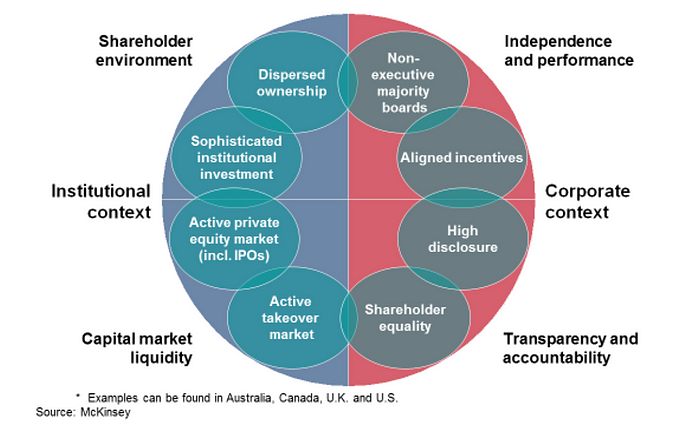

The market model governance chain²¹ which is dominant in countries such as Australia, Canada, UK and US is defined by two dimensions: the corporate and the institutional context. It comprises four factors: independence, transparency, capital market liquidity, and shareholder environment. For Facebook, I have discussed the first dimension, its corporate context, above.

The second dimension, the institutional context, specifically the fourth factor, the shareholder environment of Facebook, is significant. Shareholder environment is characterised by a dispersed ownership and sophisticated institutional investment. But in Facebook’s case large blockholders as well as a concentration of voting shares is predominant. Facebook is a public company but de facto it is a private because its CEO holds 13% of Total Shares Outstanding as the controlling shareholder²². The firm also issues dual class shares without voting rights²³ what consequently limits the shareholder power²⁴ even more — what is the contrary of powerful, engaged, voting shareholders²⁵.

2.5 Facebook’s financial structure and situation

Stakeholders in the entire economy rely on a company’s accurate and timely reporting of its financial structure and situation. The key accounting concept is that financial reports and accounts are true and fair. The Sarbanes-Oxley Act²⁶ in 2002 states that companies are required to comply with legislative standards of disclosure and audit. There have to be “true and fair” and free from “incorrect” misstatements financial controls and reporting rules. The directors are personally responsible²⁷ for the accuracy and completeness of the financial reports.

Facebook’s financial reports and accounts²⁸ from 2018–2020 exhibit its health, financial performance, and business value. The company operates mainly in a high growth market — digital advertising — and is faced with high risks. Its financial health is primarily threatened by regulatory and managerial risk. Regarding its performance, the firm hit an all-time high in revenues in 2020. But Facebook experienced a relatively low total performance from 2018 to 2020 and displayed a low profitability, financial ratios, etc. in 2019. With regards to financial health, it outperformed in liquidity over the last three years. However, the company showed a lower operating efficiency in 2019. Generally, Facebook’s future prospects look bright, whereas the financial reports and accounts reveal that it is under pressure. The firm is now at a growth stage in terms of its size, but its senior management might not be able to cope with the growing scrutiny from regulators and its increasing expenses.

2.5.1 Business approach

Facebook’s business approach is to provide social networking apps for stories, shops, groups, news feed, marketplace, watch, immersive video, reels, messaging, live, and news. Its competitive advantage is based on the monetizable database, growing user community, high liquidity, and revenue growth. However, its business model is threatened by lawsuits for illegal monopolisation.²⁹ The user data which the company controls and owns constitutes its competitive advantage. Its large and monetizable database offers high amounts of very valuable information about users, their social relationships, and their web activities to advertisers and developers. Facebook has a vast and increasing global community: 1.8 billion of daily active users (+11% YoY in 2020) and 2.8 billion monthly active users (+12% YoY). Generally, the firm has high liquidity and it especially improved in 2020. Facebook’s current ratio was 5.1 in 2020, compared to 4.4 in 2019. It showed a high revenue growth driven by ads in 2020. The company’s revenue performance was $85,965 million (+21.6% in 2020).

2.5.2 Financial reports

Facebook’s financial reports display that net income as a percentage of revenue decreased from 2018 to 2019 but increased in 2020 — not reaching the 2018 level. This decline in net income is caused by a 51% rise in costs and slowing growth. In 2019, the company struggled to cope with several regulatory issues.

The firm’s current assets declined from 2018 to 2019 and again in 2020. In 2019, it exceeded the expectations of the financial analysts regarding the top and bottom lines (revenue and profits). The company’s net income growth slows (+6% YOY in 2019 vs. 61% in 2018). The revenue growth continued by 25% YOY but was down in contrast to 2018. Advertisement revenue grew by 25% to $20.7 billion and other revenues increased by 26% to $346 million. Ad revenue growth was generated by the continued growth in users.

On the contrary Facebook’s total liabilities raised in 2019 but slightly declined in 2020. This is caused by both current liabilities and non-current liabilities which increased in 2019 but slightly decreased in 2020. The total liability increases in 2019 was caused by increasing costs and expenses to $46.71 billion (+51% YOY) and a declining operating margin (from 45% 2018 to 34% 2019). Especially, capital expenditures were at $4.24 billion. This growth in costs outpaced revenue growth for several years but not at this large extend. In 2019, Facebook struggled with several regulation issues related to data misuse and anti-competitive practices — for instance, with the company’s diversification into the digital currency Libra, which was pushed back by regulators globally.

2.5.3 Facebook’s risk and internal control systems

In general, the opportunity and risk of Wates’ six principle³⁰ state that a corporate board should promote long-term sustainable success. Success is first achieved by identifying opportunities to create and preserve value and second by establishing oversight for the identification and mitigation of risks.

Opportunity

First, the responsibility of a board is the consideration and assessment of the creation and preservation of value long-term. Boards are required to consider tangible as well as intangible value sources and the stakeholders which contribute. Processes are necessary to identify innovative and entrepreneurial opportunities in the future. Further processes should be implemented to ensure that new valuable business opportunities are considered and approved at board level.

In its business model Facebook creates value by selling advertising placements to advertisers. However, with personalised advertisements advertisers can reach customers based on behavioural factors. Advertisers buy ads to be advertised across multiple products: Facebook, Instagram, Messenger, third-party applications, and websites.

With regards to strategic opportunities, the social media company primarily operates in the global digital advertising market. The company’s competitors are search engines, online shopping websites and other platforms. The industry’s key buyers are advertising companies, ads agencies, and governments. Main suppliers are computer manufacturers, IT and real estate providers.

The firm’s growth is based on innovative initiatives with a focus on the e-commerce business and a positive forecast for the global media market. But competitive pressures, the tight regulatory environment and security breaches may negatively impact its reputation and business operations. The company achieves growth by strengthening its business through different entrepreneurial initiatives. For instance, in 2021 Shopify and Facebook build a partnership to expand its payments tool Shop Pay to merchants on Facebook and Instagram. Facebook has a strategic focus on online shopping to grow its business. For example, in 2020 it completed its launch of a new e-commerce hub, Instagram Shop, in the US. The firm benefits from a positive outlook for the global media market and especially its largest market North America. The media services market in North American is predicted to reach a market value of $436.7 billion by 2024.

Risk

Second, a board has a duty for the organisation’s approach to strategic decision-making and effective financial and non-financial risk management (reputational risk). The board is required to oversee risk, risk management, and the appropriate accountability of executives to stakeholders. Internal control systems have to be installed to manage and mitigate emerging and principal risks.

Facebook as a future technology social media platform is heavily exposed to different risks³¹. Regulatory risk in combination with reputational risk poses the most threat to Facebook’s business model which is predominantly based on advertising³².

Regulatory risk

The company primarily faces an increasing regulatory risk. Since the Cambridge Analytica Scandal during the presidential elections in 2016, Facebook is under scrutiny of regulators due to data privacy and security, fake news and hate speech and anti-trust cases. The latest issue was last Saturday when 533 million Facebook user phone numbers and personal data have been leaked online. Just before was the news ban from Facebook in Australia to fight against the new Australian media law. This confrontative strategy against regulation might backslash and increase the passing of copyright laws to strengthen the news publishers’ right to compensation against Facebook worldwide. The spread of the storming of the United States Capitol on Facebook during the presidential elections in January 2021 constituted another hate speech incident. In addition, the European Union opened an anti-trust case against the company.

Reputational risk

Furthermore, Facebook is facing a rising reputational risk — from proliferation of fake news to content moderation policies around hate speech and propaganda. In 2020, the firm was accused for its politically biased content moderation in India. In Myanmar Facebook came under fire for its insufficient content moderation against the perpetration of genocide against Myanmar’s Rohingya Muslim community.

Revenue risk

Regulatory and reputational risk interplays with Facebooks large dependency on advertisement revenue. In June 2020, an increasing list of big brand advertisers halted spending on Facebook due to its compliance with hate speech. The threat to Facebook deepened in combination with the economic slowdown of the COVID-19 pandemic.

Responsibilities

The installation of an internal control framework with clearly defined roles and responsibilities is mandatory for boards. The board should define the approach to reporting: reporting frequency, decision-making and escalation thresholds.

First, the board is responsible for the development of a risk management systems that identifies emerging and established risks. The board should be enabled to make informed and robust decisions for risks such as environmental³³, social and governance issues. Second, the board’s duty is to define the organisation’s ‘risk appetite’ i.e., a definition of the nature and extent of the most important risks and the risks which the company is willing to take to achieve its strategy. Third, the board should establish a management and mitigation process for the most pressing risks. Fourth, the task of the board is to create clear internal and external communication channels for the identification of risk factors and fifths to agree on a monitoring and review process.

Digital disruption poses new requirements to the board’s accountability. Specifically, data has become a company’s critical infrastructure³⁴. With fake news, the power, privacy, and ethics of companies have shifted. Therefore, new board issues have arisen. These new responsibilities comprise privacy and enterprise risk as well as the engagement of the board with information security and privacy issues. The creation of a Privacy and Information Oversight Committee and Compliance Oversight Committee Remit. In addition, individual directors are held to be accountable for the company’s privacy and information security.

Facebook’s board was not able to manage and mitigate the risks to which it was exposed in the Cambridge Analytica Scandal and is still struggling to do so. Due to the Cambridge Analytica Scandal, fake news, and data security, Facebook is under increasing regulatory scrutiny. Through the Facebook Settlement in 2019, the regulator forced the company to install internal control systems. This means that the company has been held accountable for these new board issues.

The court case with the Federal Trade Commission (FTC) was settled with a $5bn penalty. The settlement also included the creation of a Board Privacy Committee³⁵ with Facebook Officers and Employees. The committee’s responsibility is to be informed about material privacy risks and issues. In addition, the order directed to create a designated ‘Expert’ Compliance Officers. Furthermore, a quarterly certification to the Federal Trade Commission that Facebook complies with Privacy Programme was implemented. This means that the CEO must certify quarterly that Facebook’s Privacy Programme complies with Facebook Settlement Order.

Furthermore, Facebook has established an additional internal control framework to manage and mitigate the new board issues cased by digital disruption. In October 2020, the firm installed an Oversight Board³⁶, a new experiment in digital platform governance. The board is a body that decides on content moderation for the company.³⁷ Its goals are the improvement of the fairness of the appeals process, provision of oversight and accountability form the outside, and improvement of transparency. The board has the power to overrule content moderation decisions in accordance with Facebook’s policies and public interest.³⁸ The body is currently reviewing the deplatforming of Donald Trump from January 2021³⁹, Facebook oversight board overturns 4 of 5 items in its first decisions. Next up for the board: Weighing in on Facebook’s decision to indefinitely suspend the accounts of former President Donald Trump.

2.6 Facebook’s relationships with and prioritisation of stakeholders

Regarding Facebook’s relationships with and prioritisation of stakeholders, I will assess the weight the board gives to the interests of shareholders, employees, local communities, suppliers, customers, government, regulators and other stakeholders⁴⁰. I will give an example in which Facebook’s directors and managers succeeded in aligning and reconciling these different and often competing interests.

2.6.1 Stakeholder relationships and engagement

In general, Wates’ six principles to improve corporate governances⁴¹ request for stakeholder relationships and engagement that directors foster effective stakeholder relationships in line with the company’s purpose. Consequently, the board has the responsibility to monitor a meaningful engagement with stakeholders — specifically the workforce — and regard their views in decision making.

Stakeholder engagement

In the Provision 5 of the Code the board is requested to understand the views of the company’s other key stakeholders and consider their interests and the matters in board discussions and decision-making.⁴²

Board engagement with stakeholders is described in Principle D of the Code as that the board should ensure effective engagement with and encourage participation from its stakeholders. Three steps should be taken to understand stakeholder views: identifying stakeholders, engaging with them, and understanding their views.

Frist, for the identification of stakeholders and issues boards have to analyse how stakeholders affect the formation and execution of the company’s strategy. In addition, key concerns for each stakeholder group and their evolving needs should be taken into account through stakeholder feedback. Second, for the engagement with stakeholders it is mandatory to report on the outcomes of engagements and why main decisions were taken for that engagement. Third, for the understanding of stakeholder views the board has to address the future implications and planned actions which come up from the stakeholder’s feedback and impacts of decisions.

Workforce focus

Digital disruption poses new requirements to the board’s accountability. Besides data as a critical infrastructure, both the consumer and employee power⁴³ have increased.

Provision 5 of the Code⁴⁴ states the requirements for the board to understand the views of the organisation’s workforce and consider their interests in board discussions and decision making. General themes to consider their interests are alternative arrangements, non-executive director, advisory panel, and workforce director.

Similar to tech companies like Google on gender discrimination and AI-related biases, Facebook is facing growing employee activism⁴⁵. The related governance issues can be internal or external issues. The first can be employment-related issues such as payments. The latter are social issues such as ethics e.g., product development and production as well as governmental contracts. In June 2020, the company’s employees publicly opposed the CEO’s decision not to remove a post from Donald Trump about the George Floyd demonstrations for the first time.

2.7 General context in which Facebook operates

The analysis of the general context in which the Facebook operates helps to uncover the ethical issues which arise in relation to its corporate activity and the relationship between corporate, personal and societal values. The concept of corporate social responsibility and its implications for management and strategy will explain how ‘digitalisation’ of society affects the view of ethics in business.

The range of business ethics issues

The concept “The range of business ethics issues”⁴⁶ gives three dimensions to analyse ethical matters: systemic issues, corporate issues, and individual issues.

First, systemic issues are questions around the economic, political, legal, or other social systems within which businesses operate. Second, the corporate issues are defined as concerns raised about a particular company e.g., questions about the morality of the activities, policies, practices, or organizational structure. Third, individual issues comprise questions about a particular individual within an organization and their behaviours and decisions.

In the case at Facebook, the employee activism came up as an individual and corporate issue. At the individual level, the employees voiced their disagreements on social media platforms. At the corporate level, they organised an online strike against their firm.

Researchers who were funded by the Chan Zuckerberg Initiative (CZI) joined the protests with an open letter which opposed against the firm’s role in diffusing fake news. The company reacted adequately by taking the complaints seriously. Facebook was aware that the upheaval caused reputational damage as an employer and occurred higher costs in monitoring its employees.

Digital disruption poses new requirements to the board’s accountability. In addition to employee power, social media has enabled the shift in social power⁴⁷ from the company to the society.

This first case of employee activism at Facebook became a societal issue when a coalition of civil rights activists also joined the protests and started the “Stop Hate for Profit” campaign against Facebook, advertisers and large corporates stopped spending advertising revenue on the platform. Consequently, the campaign caused reputation and financial issues to Facebook. In this case the company displayed “good” governance by giving in and announcing new policies for the platform.

3. Conclusion

In conclusion, Facebook’s corporate governance structures and processes do not yet fulfil the requirements of “good” corporate governance. There is a disconnect between what Facebook says about its governance and ethics around data privacy and hate speech and what it does. The company’s board structure and processes show that there is no effective, entrepreneurial, and prudent management that can deliver the long-term success.

Frist, the board does not perform well in its monitoring role. The power is concentrated in the CEO because of his dual seat as Chairman of the board. The “independent” directors might not be fully independent due to personal relationships with the senior management.

Second, Facebook’s financial structure is characterised by its main operations in a high growth market — digital advertising — but faces high risks. The firm’s health is primarily threatened by regulatory, reputational, and managerial risk. The company hit an all-time high in revenues in 2020, but showed especially low profitability, financial ratios, etc. in 2019.

Third, Facebook operates in the digital disrupted market of social media. Despite good attempts, the internal control systems are not yet in place to manage and mitigate data privacy, hate speech, and human rights.

Fourth, the firm has a clear shareholder preference, but the first upheaval of its employees in 2020 accusing it of the diffusion fake news, made them adapt to a situational good workforce governance.

Finally, the social and ethical context of the firm is defined by the social media platform. When the employee activism spilled over to the corporate level the company showed “good” governance by announcing new social and ethical policies for the platform.

4. References

[1] Holmes, A. (2021) 533 million Facebook users’ phone numbers and personal data have been leaked online. Business Insider. Retrieved from https://www.businessinsider.com/stolen-data-of-533-million-facebook-users-leaked-online-2021-4?r=US&IR=T

[2] Financial Reporting Council (2018a) The UK Corporate Governance Code. London: Financial Reporting Council, p. 4

[3] Learmount, S. (2021) Seminar Corporate Governance and Ethics 1/6. Cambridge: University of Cambridge, 1/6; Stiles, P. (2021) Seminar Corporate Governance and Ethics 2/6. Cambridge: University of Cambridge, 2/6

[4] Friedman, M. (1970) “The social responsibility of business is to increase its profits.” The New York Times Magazine, 13 September

[5] Financial Reporting Council (2018b) The Wates corporate governance principles for large private companies. London: Financial Reporting Council, p. 1f

[6] Financial Reporting Council (2020) Corporate Governance Report: Review of corporate governance reporting. London: Financial Reporting Council, p. 7

[7] Financial Reporting Council (2020) Corporate Governance Report: Review of corporate governance reporting. London: Financial Reporting Council, p. 22ff

[8] Lorsch, J. W. and Clark, R. C. (2008) “Leading from the Boardroom.” Harvard Business Review, 86(4), p. 105f

[9] Stiles, P. (2021) Seminar Corporate Governance and Ethics 2/6. Cambridge: University of Cambridge, 2/6

[10] Facebook (2020e) Compensation, Nominating & Governance Committee Charter. Menlo Park: Facebook.

[11] Gordon, J. and Gilson, R. (2019) Board 3.0: An Introduction. The Business Lawyer, Vol. 74, Spring 2019

[12] Financial Reporting Council (2018a) The UK Corporate Governance Code. London: Financial Reporting Council

[13] Facebook (2020b) Corporate Governance Guidelines. Menlo Park: Facebook

[14] Stiles, P. (2021) Seminar Corporate Governance and Ethics 2/6. Cambridge: University of Cambridge, 2/6

[15] Stiles, P. (2021) Seminar Corporate Governance and Ethics 2/6. Cambridge: University of Cambridge, 2/6

[16] Boivie, S., Bednar, M.K., Aguilera, R.V. and Andrus, J.L. (2016) “Are Boards Designed to Fail? The Implausibility of Effective Board Monitoring.” Academy of Management Annals, 10(1), p. 328

[17] Stiles, P. (2021) Seminar Corporate Governance and Ethics 2/6. Cambridge: University of Cambridge, 2/6

[18] Braithwaite, T. (2021) Jeff Bezos — Independent Chairman? Financial Times. Retrieved from https://www.ft.com/content/efbe2bc3-bafb-4291-b045-e797c31fb3bc, p. 2f

[19] Stiles, P. (2021) Seminar Corporate Governance and Ethics 2/6. Cambridge: University of Cambridge, 2/6

[20] Stiles, P. (2021) Seminar Corporate Governance and Ethics 2/6. Cambridge: University of Cambridge, 2/6

[21] Stiles, P. (2021) Seminar Corporate Governance and Ethics 2/6. Cambridge: University of Cambridge, 2/6

[22] Facebook (2020g) Stock Ownership Guidelines. Menlo Park: Facebook, p. 1

[23] Facebook (2020c) Certificate of Incorporation. Menlo Park: Facebook, p. 2ff

[24] Rau, R. (2020) Seminar Economics, Organisations and Incentives 1–4. Cambridge: University of Cambridge, 4/4

[25] Learmount, S. (2021) Seminar Corporate Governance and Ethics 3/6. Cambridge: University of Cambridge, 3/6

[26] Learmount, S. (2021) Seminar Corporate Governance and Ethics 3/6. Cambridge: University of Cambridge, 3/6

[27] Bagley, C. E., Cova, B. and Augsburger, L. (2017) How boards can reduce corporate

misbehavior. Harvard Business Review. Retrieved from https://hbr.org/2017/12/how-boardscan-reduce-corporate-misbehavior , p. 1f

[28] Facebook (2020a) Annual Report 10-K. Menlo Park: Facebook

[29] MarketLine (2021a) Company Facebook Inc. Retrieved from https://advantage-marketline-com.proxy.jbs.cam.ac.uk/Company/Summary/facebook-inc

[30] Financial Reporting Council (2018b) The Wates corporate governance principles for large private companies. London: Financial Reporting Council, p. 6f

[31] Facebook (2020a) Annual Report 10-K. Menlo Park: Facebook

[32] Facebook (2021) Audit & Risk Oversight Committee Charter. Menlo Park: Facebook, p. 5

[33] Baker, M. and Roberts, J. (2011) “All in the Mind? Ethical Identity and the Allure of Corporate Responsibility.” Journal of Business Ethics, 101, p. 6ff

[34] Learmount, S. (2021) Seminar Corporate Governance and Ethics 5/6. Cambridge: University of Cambridge, 5/6

[35] Facebook (2020f) Privacy Committee Charter. Menlo Park: Facebook

[36] Klonick, K. (2021) Inside the Making of Facebook’s Supreme Court. The New Yorker. Retrieved from https://www.newyorker.com/tech/annals-of-technology/inside-the-making-of-facebooks-supreme-court

[37] Facebook (2018) A Blueprint for Content Governance and Enforcement. Facebook. Retrieved from https://m.facebook.com/nt/screen/?params=%7B%22note_id%22%3A751449002072082%7D&path=%2Fnotes%2Fnote%2F&refsrc=http%3A%2F%2Fwww.google.com%2F&_rdr

[38] Van Loo, R. (2020) Federal Rules of Platform Procedure. University of Chicago Law Review, Forthcoming, Boston Univ. School of Law, Law and Economics Research Paper, Retrieved from https://ssrn.com/abstract=3576562

[39] Mihalcik, C. and Wong, Q. (2021) Facebook oversight board overturns 4 of 5 items in its first decisions. Cnet. Retrieved from https://www.cnet.com/news/facebook-oversight-board-releases-its-first-decisions/

[40] Henderson, R. and Temple-West, P. (2019) “Group of US Leaders Ditches the Shareholder-First Mantra.” Financial Times, 19 August, p. 1f

[41] Financial Reporting Council (2018b) The Wates corporate governance principles for large private companies. London: Financial Reporting Council, p. 11f

[42] Financial Reporting Council (2020) Corporate Governance Report: Review of corporate governance reporting. London: Financial Reporting Council

[43] Learmount, S. (2021) Seminar Corporate Governance and Ethics 5/6. Cambridge: University of Cambridge, 5/6

[44] Financial Reporting Council (2020) Corporate Governance Report: Review of corporate governance reporting. London: Financial Reporting Council, p. 30

[45] Tihanyi, L., Graffin, S. and George, G. (2014) “Rethinking Governance in Management Research.” Academy of Management Journal, 57(6): p. 1537

[46] Stiles, P. (2021) Seminar Corporate Governance and Ethics 4/6. Cambridge: University of Cambridge, 4/6

[47] Learmount, S. (2021) Seminar Corporate Governance and Ethics 5/6. Cambridge: University of Cambridge, 5/6

Thanks for reading! Liked the author?

If you’re keen to read more of my Leadership Series writing, you’ll find all articles of this weekly newsletter here.